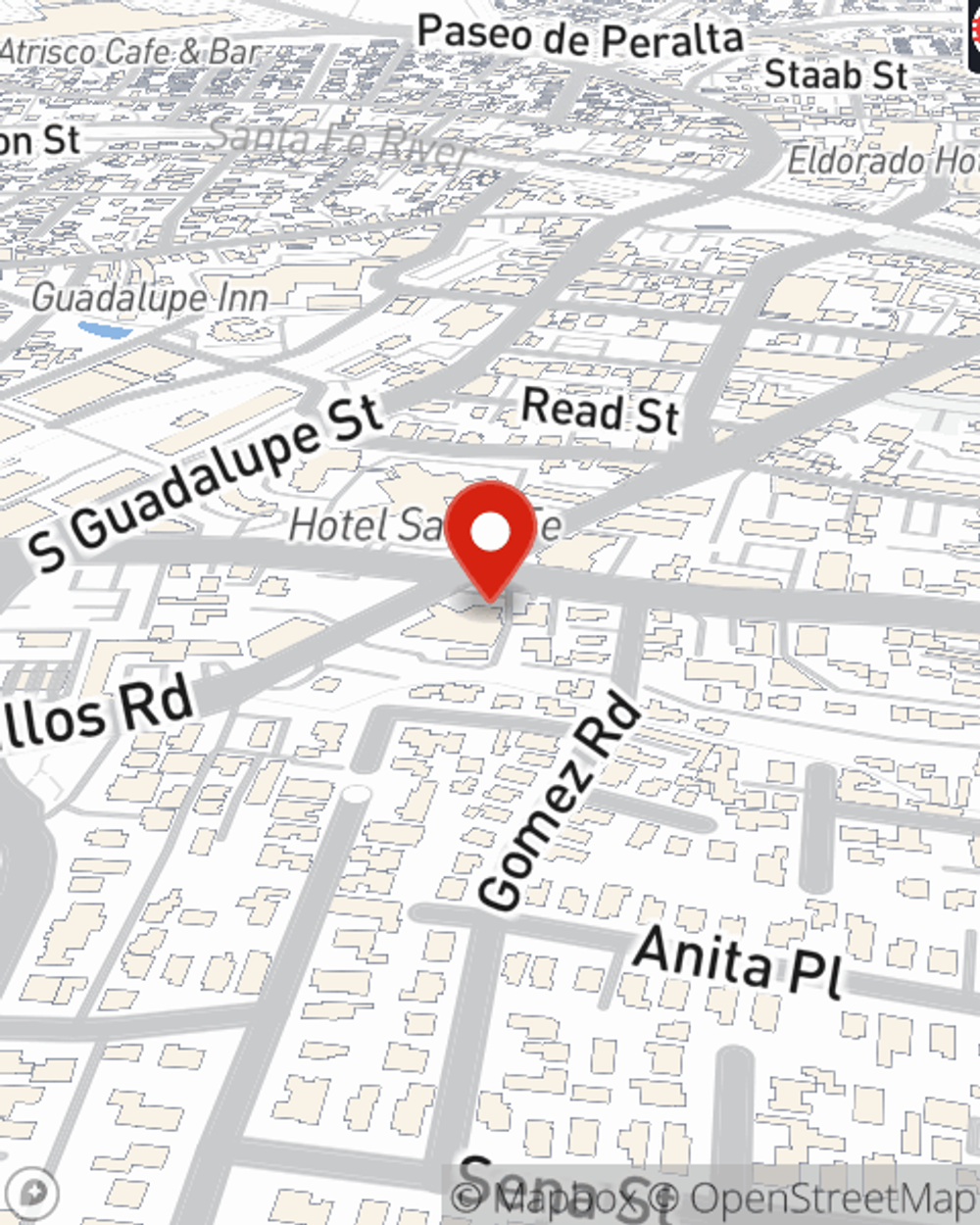

Business Insurance in and around Santa Fe

One of the top small business insurance companies in Santa Fe, and beyond.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Whether you own a a flower shop, a pet groomer, or a pharmacy, State Farm has small business coverage that can help. That way, amid all the various decisions and moving pieces, you can focus on what matters most.

One of the top small business insurance companies in Santa Fe, and beyond.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

Your business thrives off your tenacity creativity, and having dependable coverage with State Farm. While you lead your employees and put in the work, let State Farm do their part in supporting you with business owners policies, commercial liability umbrella policies and commercial auto policies.

As a small business owner as well, agent Garrett Seawright understands that there is a lot on your plate. Visit Garrett Seawright today to get more information on your options.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Garrett Seawright

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.